4.4 Banking:

General introduction to Banking.

Have you been to any Bank? You must have observed many activities there. Some may be depositing(putting in) money and others may be taking out money. Also, you must have heard people speaking about words interest, loan, Cheque, Demand Draft (DD).

Have you heard people saying that interest they get is too low and it is difficult to meet household expenses? For them interest is an income used for daily living.

You need money to start a business or to buy items. We can borrow money from people or organizations. Bank is one such institution which lends money to borrowers. The borrowers could be individuals, companies. Individuals need money to construct houses ,to purchase houses, sites, items such as TV, Fridge, Motor Cycles, cars, etc,. . Farmers also need money for buying land, cattle, fertilizers, tractors and farm equipments. . People need money to start business. Companies also require money to expand business. Students also need loan for higher studies. Many others need money for marriages and for other social functions. Banks give money to all these type of borrowers. But can Banks give money free? Banks also have expenses (pay salary to their employees, pay rent for building, pay for electricity pay for buying computers …,). interest on loan is the extra charge that banks collect from borrowers to meet these expenses and make some profit. How do banks get money to give it to borrowers?

They collect money from depositors who have some extra money (from their savings). Will these depositors give money to Bank free? The depositors also need some incentive (encouragement), so that they can give money to Banks. Thus, Bank is an organization that collects money from depositors and gives money to borrowers. To encourage depositors to give money, banks give ‘interest’ to depositors on the money they give to Bank. Similarly, bank charges ‘interest’ from people who borrow money from Bank. So we can say Banks act as ‘middleman’ between those who have extra money (depositors) and those who need money (borrowers).

State Bank of India (SBI), State Bank of Mysore (SBM), Syndicate Bank, Canara Bank, Citi Bank, HSBC Bank are some of the examples of Banks operating in India.

Banks need a system with which they can record the transactions of their customers (depositing money and taking out money). For this reason, every individual or company needs to open an account in the Bank. At the time of opening account, Banks check the background of individuals by asking them to produce few documents (Address proof, Date of birth proof….)

When an account is opened, Bank gives a unique number to each depositor called ‘Account Number’. When an individual opens an account he is given a ‘Savings Bank Account’. When a company opens an account it is given a ‘Current Account’. When a businessman opens an account he is given a ‘Current Account’.

Depending on the needs of the account holder, accounts are mainly classified as:

1. Savings Bank (SB) account

2. Current Account (CA)

3. Recurring Deposit Account (RD)

4. Fixed or Term Deposit (FD)

5. Cumulative Term Deposit (CTD)

Opening of account

As an example let us look at how to make an application to open an SB account in Syndicate Bank. The procedure and the application form used for opening accounts are more or less same in all banks. The person opening an account needs to know a person called introducer who also should be known to the Bank. This introducer needs to certify that the account opener is known to him for few years. This way the bank ensures that the person opening an account is a responsible person and is unlikely to cheat the bank

The requirements for opening account are:

1. Completed application form

2. Photos of the individuals opening the account

3. Initial deposit amount

4. Copy of Voter ID card; ration Card, Driving License or pass port as proof of address

5. Specimen signature card

The front page of the application form looks similar to as given below.

In the form, the photo of the individual who is opening the account needs to be affixed in the space provided.

The photo helps in identifying the account holder

The reverse side of the Account opening form looks as given below.

.

|

Circled Number |

Details |

Entry in the above form |

|

1 |

Unique number(called Account Number) given to the account holder |

14502 |

|

2 |

Initial deposit amount |

2000 |

|

3 |

Name of the account holder |

Ramesh K N |

|

4 |

Occupation of account holder |

Student ( assumed that he is a major) |

|

5 |

Address (proof such as voter ID card, Ration card. are to be submitted to the bank) |

5, 5th Main,3rd Cross R K Puram, Bangalore -560 070 |

|

7 |

Date of the opening of account |

07/04/2006 |

|

8 |

Signature of account holder |

Signature of Ramesh K N |

|

9 |

How many years since the account opener is known to the introducer. |

Three years |

|

10 |

Name of the introducer |

Ramesh Chandra |

|

11 |

Signature of the introducer with date |

Signature |

|

12 |

Introducer’s account number in the Bank |

12305 |

|

13 |

Account number allotted to the person opening the account |

14502 |

|

14 |

Date on which account was opened |

07/04/2006 |

|

15 |

Signature of the Manager of the Bank |

Signature |

Bank maintains a Card which has two specimen (sample) signatures of the account holder. Normally banks scan the signature and store them in computer.

An example of the card used by Syndicate Bank is given below

|

Circled Number |

Details |

Entry in the above card |

|

1 |

Account Number given to the account holder |

14502 |

|

2 |

Name of the account holder |

Ramesh K N |

|

3 |

Address (proof such as voter ID card, Ration card. are to be submitted to the bank) |

5, 5th Main,3rd Cross R K Puram, Bangalore -560 070 |

|

4 |

Name of the signatory( the person authorized to sign cheque) |

Ramesh K N |

|

5 |

Two signature of the signatory |

Signatures |

|

6 |

Signature of the Manager of the Bank |

Signature |

|

7 |

Date on which account was opened |

07/04/2006 |

Now an SB account can be opened by Ramesh K. N after making an initial deposit

To deposit amount in to an account, we use a slip called ‘pay in slip’. While depositing money we need to give bank some details

As a sample, slip used by Syndicate Bank is given below:

Note that the slip has two parts. Right side is for Bank’s use and left side is for Depositor’s record

Let us understand the details to be filled up on the Bank Copy. Most of the same information is filled up on the left side also.

|

Circled Number |

Details |

Entry in the above slip |

|

1 |

Name of the Bank’s Branch |

Jayanagar |

|

2 |

Date (of deposit) |

03-04-06 |

|

3 |

Paid in to the credit of(Nature of account) |

SB(Savings Bank) |

|

4 |

A/C Holders name |

Ramesh K.N. |

|

5 |

Amount of deposit in words |

Two thousand only |

|

6 |

A/C No( Account Number) |

14502 |

|

7 |

Amount of deposit in figures |

2000 |

|

8 |

Signature of Depositor |

Signature |

|

6 |

Cash/Cheque(The method of deposit) |

Cash |

|

9 |

Denomination(The break of amount in different currency notes) |

500X2 = 1000,100X10 = 1000 Total Rs. 2000. |

Note: Since authorization is not required for depositing money, any one can deposit to any one’s account.

We need to provide certain details to bank when we want to take out money from bank and we provide these details in ‘Withdrawal form’

As an example let us see what needs to be filled to withdraw money from the bank using the form of State Bank of India.

|

Circled Number |

Details |

Entry in the above slip |

|

1 |

Name of the Account Holders |

Padmakshi |

|

2 |

Date (of withdrawal ) |

01-05-2006 |

|

3 |

Account Number in the Bank |

14110 |

|

4 |

Amount of withdrawal in words |

Five Hundred |

|

5 |

Amount of withdrawal in figures |

500 |

|

6 |

Debit the amount to my/our SB A/C No |

14110 |

|

7 |

Signature of Depositor |

Signature(It should be as per specimen signature card given to the bank) |

There are some restrictions on the use of withdrawal slip. They are:

1. Only the account holder can use this slip to withdraw the amount for himself

2. This form can not be used to make payment to others.

3. Account holder has to produce the pass book

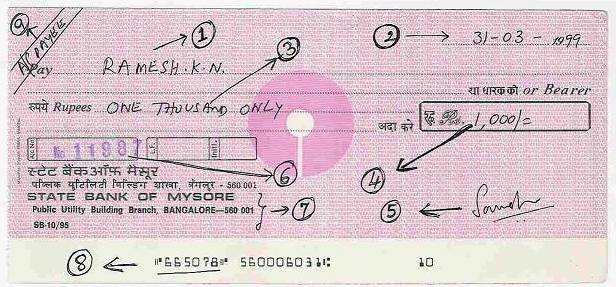

Since withdrawal slip can not be used to make payment to others, we use a form called cheque

Let us see what needs to be filled in a cheque so as to pay amount to others. As an example let us study the cheque format used by State Bank of Mysore

In the cheque we write certain details which are needed to make payments

|

Circled Number |

Details |

Entry in the above cheque |

|

1 |

Pay ( Name of the person who needs to be paid) |

Ramesh K.N |

|

2 |

Date ( Date on which the money is to be paid) |

31-03-1999 |

|

3 |

Rupees(The amount to be paid in words) |

One Thousand only |

|

4 |

Rs. (The amount to be paid in Figures) |

1000 |

|

5 |

Signature of the person issuing cheque |

Signature(It should be as per specimen signature card given to the bank) |

|

6 |

Account Number of the person issuing cheque |

11987 |

|

7 |

Branch Name(The branch where the person who is signing the cheque is having the account) |

State Bank of Mysore Public Utility Branch, Bangalore -560 001 |

|

8 |

Cheque Number |

665078 |

|

9 |

Mode of Payment |

A/C Payee |

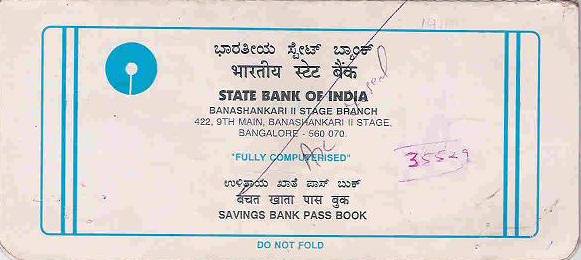

When an account is opened with a bank the bank gives a pass book which lists the transactions carried out in that account

Almost all the banks have similar formats for pass book.

As an example, let us look at the pass book entry of an account holder of State Bank of India which is given below

The front page of the pass book looks like:

The front page of the passbook specifies the name and address of the branch. In the above example

The bank name is ‘STATE BANK OF INDIA’ and the address of the branch is ‘ 422,9th Main, Banashankari II Stage, Bangalore -560070’

The inside page of the pass book looks as given below:

|

Circled Number |

Details |

Entry in the above pass book |

|

1 |

Name of the Account holder |

Padmakshi and Veena |

|

2 |

The address of the account holder |

2282, 22nd Cross, K R Road… |

|

3 |

The Account number |

01190014110 |

Note that since this account is in two names, the account is called a ‘joint account’

The next and subsequent pages give the details of the transactions carried out by account holder.

Let us assume that this account holder does following transactions.

TABLE 1:

|

Date of Transaction |

Details |

Reference Number |

Amount taken out - |

Amount put in + |

Balance |

|

1 |

2 |

3 |

4 |

5 |

6 |

|

23/09/97 |

A/C Opening |

SD14039 |

|

500.00 |

500.00 |

|

03/10/97 |

By Cash |

SD14086 |

|

10000.00 |

10500.00 |

|

24/10/97 |

By Cash |

|

|

3750.00 |

14250.00 |

|

24/10/97 |

By Cash |

SD 14014 |

|

10000.00 |

24250.00 |

|

04/11/97 |

To Agrahar & Co |

VB5181 |

15000.00 |

|

9250.00 |

|

05/11/97 |

By Cash |

SD013014 |

|

30000.00 |

39250.00 |

|

06/11/97 |

By Clearing |

|

|

30000.00 |

69250.00 |

These transactions appear in the pass book as given below

|

Circled Number |

Details |

Explanation |

|

1 |

Date of Transaction |

The date on which money was deposited or withdrawn. |

|

2 |

Details |

How the money has come in to the account or to whom money has been given, and how it was taken out. |

|

3 |

Reference Number |

The internal number used by bank or the cheque number of the cheque. |

|

4 |

Amount taken out - |

Amount withdrawn from the account. This reduces the money available in the account. |

|

5 |

Amount put in + |

Amount deposited in to the account. This increases the money available in the account. |

|

6 |

Balance |

The balance amount in the account on a particular day. |

The difference between various types of accounts can be summarized as follows:

|

No. |

Features |

Savings Bank Account(SB) |

Current Account(CA) |

Recurring Deposit(RD) |

Fixed Deposit(FD) |

Cumulative Term Deposit(CTD) |

|

1 |

Opened by |

Individuals |

Business man or Companies |

??????? |

Any one |

Any one |

|

2 |

Maturity period |

Operative till it is closed |

Operative till it is closed |

Fixed number of months |

Fixed number of days |

Fixed number of days |

|

3 |

Deposits |

No limit on the amount or the number of times a deposit is made |

No limit on the amount or the number of times a deposit is made |

Every month a fixed minimum amount needs to be deposited |

A fixed minimum initial deposit |

A fixed minimum initial deposit |

|

4 |

No of withdrawals from Account |

Limited numbers per month Extra fee charged beyond limits |

No restriction |

On maturity |

On maturity |

On maturity |

|

5 |

Interest |

The balance in the account earns monthly interest on the minimum balance maintained between 10th and the last day of the month |

Balance does not earn interest |

Interest accumulated till maturity and paid along with deposit at the end |

Simple Interest paid quarterly. |

Interest accumulated till maturity and paid along with deposit at the end (Interest on interest is paid) |

|

6 |

Minimum Balance to be maintained/ Minimum amount of deposit |

The account holder needs to maintain minimum balance in the account on any day as decided by bank from time to time(varies from Rs.200 to Rs.1000), else he is charged service fee |

Balance can be zero any time |

There is a minimum deposit amount which varies from Bank to Bank |

There is a minimum deposit amount which varies from Bank to Bank |

There is a minimum deposit amount which varies from Bank to Bank |

|

7 |

Mode of Withdrawals |

Withdrawal slip can be used to take money out |

Only cheques can be used |

Bank pays the maturity amount by cheque |

Bank pays the initial deposit amount by cheque |

Bank pays the maturity amount by cheque |

Types of Accounts

Account in the banks or Post offices can be opened in more than one name. ‘Joint account’ is an account opened by more than one person . A joint account can have maximum of three names.

While opening the account names of all the persons are to be mentioned. In such cases Specimen signature card needs to be filled up for all the joint account holders.

In the case of operating a joint account (withdrawal of money, signing cheques) the account holders have the following options:

1. Any one can sign (useful when one account holder is out station or if he is no longer alive)

2. All need to sign (More secure as all account holders need to sign)

The option chosen by the account holders need to be intimated to Banks at the time of opening the account as seen in the following application.

The entries circled as number 3 indicates that application is for a joint account (in the names of Ramesh. K.N and Kishore. S)

The entry ‘EITHER’ circled as number 6 indicates that the account can be operated by either of the account holders Ramesh or Kishore)

We have seen earlier that money can be withdrawn using either a withdrawal slip

or a cheque

Only the account holder can use withdrawal slip to take money out of his account. To make payment to others, only cheque can be used.

However, cheque can also be used by an account holder to withdraw the money for himself

There are three parties involved in the realization (credit of amount) of cheques

1. Payee (Circled number 1): The party who receives the amount mentioned in the cheque (In the above example it is Ramesh K N)

2. Drawer (Circled number 6, 5): The party which pays the amount mentioned in the cheque (In the above example it is the account holder of account 11987 –Name not known)

2. Drawee (Circled number 7): The Bank which pays the amount on behalf of drawer (In the above example it is State Bank of Mysore)

Process of crediting the amount mentioned in the cheque

Let us assume that you (Suman) have received a cheque from your friend (Nanda) say for Rs 1000/=. In this case you are Payee and your friend Nanda is drawer

Assume that your banker (where you have an account) is Syndicate Bank and Nanda’s banker is Canara Bank.

The following sequence of operations take place before Rs 1000 is credited to your account

1. You deposit the cheque in Syndicate Bank using the deposit slip

2. Your banker (Syndicate Bank) sends the cheque to the banker of Nanda (Canara Bank.)

3. Canara Bank checks if the cheque can be cleared (passed) or not

4. If the cheque is passed by Canara Bank then Canara Bank debits the account of Drawer (Your friend) for Rs 1000 and informs Syndicate bank that cheque is passed.

5. Syndicate Bank credits the amount of Rs 1000 to the account of Payee(Your)

The above process is called ‘Cheque clearance’.

If Payee and Drawer have their accounts in the same city/town the amount is normally credited to the account of Payee in 2 or 3 days. In case of outstation cheque it may take several days.

Passing of cheque

You would have heard the term ‘bouncing of cheque’ or ‘dishonoring of cheque’. It means that the receiver of the cheque can not be credited with the amount mentioned in the cheque to his bank account.

A cheque could be dishonored due to any of the following reasons

1. The balance in the account does not have the amount specified in cheque

2. Signature/s on the cheque does/do not tally with what is given to the Bank in the specimen signature card.

3. In case of joint Accounts not all people have signed the cheque( if account is opened with joint operation)

4. In cases of overwriting/corrections on the cheque corrections have not been counter signed(one more signature)

5. Cheque is post dated(Cheque date is that of future)

6. Expired cheque date ( cheque’ s validity is normally 6 months from date of cheque)

7. The issuer of cheque has given instructions to his banker for stopping payment – called stop payment

The Government of India has made a law to

the effect that dishonoring of cheque is a criminal offence. In such cases the

person issuing the cheque can be sent to jail.

The cheques can be drawn in two ways

1. ‘Bearer cheque’: In this case the word ‘bearer’ on the cheque is not struck. This type of cheque can be encashed by any possessor of the cheque irrespective of the name written on the cheque. Thus in this there is a risk of amount being paid to wrong people

In case the word ‘bearer’ on the cheque is struck and the party’s name is written then the cheque can be encashed by any person just by signing on the reverse of cheque . In this case also there is a risk of amount being paid to wrong people(because any one can sign on the reverse side of the cheque)

2. ‘Crossed cheque’: In this case the words ‘A/C Payee’ are written across at the top left corner of the cheque.(As in circled number 9 in the format discussed earlier ). This type of cheque can be encashed only by the payee (whose name is written on the cheque) that too only after crediting the amount to the account of payee through his banker. Thus this type of cheques is more secure and even if the cheque is lost it is very difficult for the possessor of cheque to encash the cheque.

The crediting of crossed cheques follows the process of ‘Cheque clearance’ described earlier.

Thus, it is obvious that a person who does not have a bank account, can not get the amount mentioned in a crossed cheque, even if his name is written on the cheque (he is the payee)

Note: We use the Mode of payment as ‘A/C Payee’ when

1. The amount is not paid immediately in cash

2. The amount is paid only after crediting the amount to the account of the Payee.

3. Only the person (Payee) whose name is mentioned against ‘Pay’ in the cheque can receive the money.

4. Even if the cheque is misused by some one there should be a way to find who received the amount.

Demand Draft:

You must have heard people talking about a getting DD (Demand Draft), towards application fee, examination fee and for many such payments

It is a special instrument which does not get dishonored (bounced). IT is always issued by a Bank. Given below is the copy of DD issued by State Bank of Mysore,as can been seen from the name printed at the top. Notice that this DD is crossed DD as it is crossed at the left corner.

|

Enclosed within the figure |

Entry in the DD |

Details |

|

Black rectangle at the top left |

SBM - Somwarpet |

The branch of bank issuing the DD |

|

Red Rectangle against ‘ON DEMAND PAY’ |

FOODS LIMITED |

The party which gets the amount specified in the DD |

|

Red circle at the top right corner |

22/06/2006 |

Date of issue of DD (Validity period is six months) |

|

Green Circle below the date |

65000.00 |

The amount payable to the party |

|

Green rectangle in the middle |

Six – ten thousand Five – Thousands Zero – Hundreds Zero – tens Zero - units |

Amount in words |

|

Black circle at the bottom |

SBM – Service Bangalore |

The branch of bank which pays the amount |

|

Blue rectangle next to Drawee branch |

DD715693 |

Number of DD |

|

Brown rectangle on the right |

Signatures |

Two signatures of the officers of branch issuing DD |

Let us list the difference between Cheques and DDs

|

No |

Features |

Cheque |

Demand Draft(DD) |

|

1 |

Issuer |

Issued by account holder |

Issued by bank |

|

2 |

Availability of Amount |

The account need to have enough balance, at the time of passing of cheque. |

Amount need to be paid to the bank before DD is made |

|

3 |

Safety |

Can be forged easily |

Highly secure |

|

4 |

Credit of amount to the payee’s account. |

Could take few days |

One or two days |

|

5 |

Dishonoring of instrument |

Cheque may get dishonored |

Guaranteed by Bank |

|

6 |

Issue Date |

Can be pre/post dated |

Can not be pre/post dated |

|

7 |

Signature |

Signed by Accountholder/s |

Signed by 2 designated officers of the Bank |

|

8 |

Charges for issue |

Nil or negligible |

Based on the value of DD, the Bank charges commission |

As seen from the above, DD is similar to cheque but it is issued by the Bank. (Both Drawer and Drawee are Banks)

Because of this reason DD does not bounce and hence it is as good as cash. For this reason, many organizations ask for payment by Demand Draft for their products and services (issue of application forms, payment of fees, buying of products.) and not cheques.

Banks follow the procedure of cheque clearance for crediting DDs also, so as to avoid frauds in DDs

Information Technology in Banking:

1. Computerisation :

Most of the banks have computerized their operations which has reduced their paper work. Interest calculation, issue of Deposit receipts, clearance of cheques and many such routine activities are performed by computers. This has helped in increasing efficiency of banks

2. Electronic fund transfer :

This is a facility where money is transferred electronically from one account to another account without the need for issue of cheque,DD

In this method amount is credited to payees account immediately eliminating the need for ‘cheque clearance’ thereby saving time.

This method is used mainly by banks for inter bank transfer and by many companies.

3. ATM :

You must have seen people withdrawing money not from banks but from machines called ATMs (Automatic Teller Machines) from anywhere any time.

When a person opens an account with the bank, most of the banks issue an electronic card called ATM card. Along with card depositor is also provided a password( Secret code). Once the card is inserted in to ATM machine, it asks for password. If correct password is given then the person can do following activities

· Withdraw cash up to a limit (Could be Rs 10,000 per day)

· Check the balance

· Change original password

· Take print out of passbook (limited transactions)

· Request for issue of cheque book

…….

This card contains depositor’s name, account number, validity period for usage of card

This facility has been made possible because of computerization in Banks and interlinking of branches of Banks (Connectivity)

4. Internet Banking:

Quite a few banks have introduced this facility which allows depositors carry out following activities from any where in the world any time through internet

· Check the balance in account

· Print/view the account transactions(pass book)

· Request for issue of cheque book

· Request for issue of DD

· Stop payment

· ……….

Exchange Rates:

We are familiar that each country has its own currency. Since companies carry out business with other countries (export, import)

money received/to be paid need to be converted to local currencies.

The rate at which one currency is converted to another currency is called ‘exchange rate’

This exchange rate changes on daily basis depending upon the economy, market conditions, global crisis and other external factors

These rates are published in many newspapers

Some of the popular currencies and exchange rate as on October 12, 2006 is given below.

|

No |

Country |

Currency |

Rate in Rs. |

|

1 |

USA |

Dollar |

45.7 |

|

2 |

UK |

Pound |

85.26 |

|

3 |

Part of Europe |

Euro |

57.55 |

|

4 |

Singapore |

Singapore dollar |

28.95 |

|

5 |

Japan |

Yen |

00.383 |

|

6 |

Saudi Arabia |

Riyal |

12.31 |

4.4 Problem 1 : If an Indian company imports goods worth 1000 Dollars from USA, find out the amount company need to give to Bank to get amount in dollars?

Solution:

Since 1Dollar = Rs. 45.7

1000 Dollar = 45.7*1000 = Rs45,700

Since the supplier accepts only Dollars, the company pays Rs 45,700 to the bank to get the equivalent amount in dollars.

4.4 Problem 2 : If an Indian company exports goods worth Rs1,00,000 to a Japanese company. Find out how many yen it has to mention in the bill given to the Japanese company.

Solution:

Since Rs. 00.383Rs = 1 yen

1,00,000 rupees = 100000/00.383 = 2,61,097 yens

This is the amount in yen which company has to mention in the bill.

4.4 Summary of learning

|

No |

Points learnt |

|

1 |

Various forms(instruments) used by banks in respect of operation of an account in a Bank |