4.1 Profit and loss:

1 Assume that you have a friend who is a

merchant who sells chocolate

and biscuits in addition to other items

1. He sells chocolate at 11Rs after buying them

at 10Rs

2. He sells biscuit packet at 23 Rs after buying

them at 20Rs

If he wants more profit from his sales, what

do you suggest him to sell more of chocolate or more biscuit packets?

2

A shop keeper buys 1000 coconuts

by paying Rs 6000. Of these 100 coconuts were spoiled. If he sells remaining

coconuts at Rs 5, did he incur loss or profit?

We shall learn to solve

these types of problems in this and subsequent lessons

4.1.1

Percentage:

You must have heard the

word percentage very often (% marks, % rate of interest, %pass in the board

examination…)

The word percent can be

split as per and cent

and means per 100

Definition:

‘Percentage’ is a fraction with denominator as 100 and is

represented by the symbol %.

Examples are

:

7% = 7 out of 100 =

7/100 = 0.07

0.025 = 0.025*100% = 2.5%

1/5 = 1/5*100% = 20%

100% means 100 out of

100

4.1.1 Example 1:

Let your marks in

mathematics be as given below:

1) In the first

monthly test it is 15 out of 25 ( 15/25)

2) In the Mid

term examination it is 65 out of 100(65/100)

3) In the third

monthly test it is 34 out of 50(34/50)

4) In the final

examination it is 105 out of 150( 105/150)

With the above data how can

we compare your progress in Mathematics in a year?

You must have thought why

not conduct examination for 100 marks always, so that comparison is easy. We

can use percentage calculation to measure the progress.

For calculating % we

convert the basis of comparison (denominator) to 100

Let us convert the basis of

comparison to 100 in case of above example

1. The marks scored in the

first test can be represented as

For 25, the marks is 15

For 100 how much? =

(15/25)*100 = 60

Thus the marks got in the

first monthly test is 60%

2. Since the mid term exam

is based on 100, conversion is not required and hence marks got is 65%

3. The marks in the third

monthly test can be represented as

For 50, the marks is 34

For 100 how much? =

(34/50)*100 = 68

Thus the marks got in the

first monthly test is 68%

4. The marks got in the in

the final examination can be represented as

For 150, the marks is 105

For 100 how much? =

(105/150)*100 = 35*2 = 70

Thus the marks got in the

final examination is 70%

We conclude that marks

scored in mathematics are 60%, 65%, 68% and 70%.

4.1.1 Problem 1:

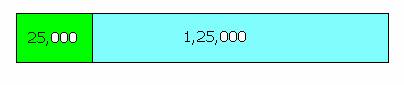

An architect’s fees are worked out at 10% of the first Rs. 25,000 and 4% on the

reminder of cost. If the cost of house is Rs. 1, 50,000 find out

(1) Architect’s fee

(2) Express the architect’s

fee as % to the total cost

Solution :

The cost of house can be

split as25,000 and 1,50,000(1,50,000 = 25000+125000)

Since Architects fee are

different for different amount, we need to be calculate the fee separately on

25,000 and 125000

1. Architect’s fee on

25,000 is 10%

10% on 25,000 =

25000*10/100 = 2500

2. Architect’s fee on 1,25,000 is 4%

4 % on 125000= 125000

*4/100 = 5000

Total fee = 2500+5000 =

7500

For the total cost of house

of Rs. 1, 50,000 his fee is Rs 7500

For a cost of Rs 100 the

fee is =(7500/150000 )*100 =5

Thus we can say the

architect has charged a fee of 5% on the total cost

Verification:

5% of 150000 = (5/100)*

150000 = 7500, which is the fee charged by the architect and hence our answer

is correct

4.1.1 Problem 2:

Government of

|

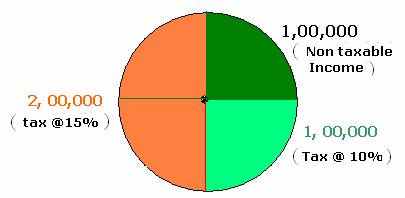

1) Of

the total income, tax is not collected on the first Rs.1,00,000 2) On

the next 1 Lakh rate of tax is 10% 3) On

the rest of the income tax rate is 15% 4) In

addition, on the total tax collected it charges an educational cess(levy) of

2% Find

out the following for an individual whose income is Rs 4,00,000 (1)

Total tax paid by the individual (2)

Express the total tax as % to the total income |

|

Solution :

Total income = 4, 00,000

Non taxable income = 1,

00,000

Taxable income = 3,

00,000

Since the tax rates are

different for different amount, this taxable income needs to be split as 1,00,000 and 2,00,000. We also need to be calculate

tax separately on these two amounts.

1) On the first 1 Lakh the

tax is at 10%

10% Tax on 1,00,000 = 100000*10/100 = 10,000

2) On the next 2 Lakhs the

tax is at 15%

15% Tax on 2,00,000 = 200000*15/100 = 30,000

Thus the total Income tax

to be paid is 40,000(10,000+30,000)

In addition to tax am

educational cess of 2% has to be paid

2% cess on 40,000 = =

40000*2/100 = 800

Total tax payable is = I.Tax +cess = 40000+800 =

40800

On the total income

of Rs. 4, 00,000, tax is Rs 40800

On an income of Rs 100

the tax is = (40800/400000)*100 =10.2%

Thus we can say the tax

payable by this individual is 10.2%

Verification:

10.2% of 400000 =

(10.2/100)* 400000 = 40800, which is the total tax to be paid by the

individual.

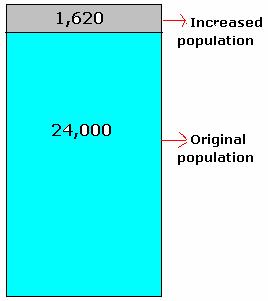

4.1.1 Problem 3: The

population of a town is 24,000. If the number of males is increased by 6% and

that of females by 9%, the population would be 25,620 .

Find the number of females in the town.

Solution :

|

Let x

be the number of males in the town. Then 24,000-x will be number of

females Since the

increase in males is 6% , the increase in males = x*6/100 Since

the increase in females is 9% , the increase in females =

(24000-x)*9/100 Total

increase =

x*6/100 + (24000-x)*9/100 =6x/100+

240*9 -9x/100 = 2160-3x/100 The

total population = original population + increase = 24,000 + 2160-3x/100 This is

given to be 25,620 25620 =

26160 -3x/100 3x/100

= 26160-25620 (Add 3x/100 to both sides and subtract 25620 from both sides)

Thus

number of males are 18,000 and number of females is 6000 Verification: Since

the increase in males is 6%, the increase in number of males =

18000*6/100 = 1080 Since

the increase in females is 9%, the increase in number of females = 6000*9/100

= 540 Total

increase = 1080+540 = 1620 Thus

the total population = original population + increase = 24,000 + 1620= 25620,

which is as given in the problem. |

|

4.1.1 Problem 4: Divide

the sum of Rs 45,500 among three persons A,B, C in such a way that A gets

(33)1/3% more than B and C gets 60% of A and B together get.

Solution :

Let x be the

amount got B

Since A gets 33 1/3 % more

than B the amount got by A = amount got by B +(33)

1/3 % of B = x+ 33(1/3)x/100 = x+(1/3)x = 4x/3

The amount got by A and B

together = 4x/3+x = 7x/3

Since C gets 60% more than

what A and B got together,

Amount got by C= 60% of

(amount got by A and B together)

= (7x/3)*60/100 = 7x/5

The amount got by A+ amount

got by B and amount got by C = 4x/3+x+7x/5

= (20x+15x+21x)/15 (15 is

LCM of 3 and 5)

=56x/15

It is given that the total

amount distributed is 45,500

45500 = 56x/15

On simplification we get x

= 12187.5 which is the amount got by B

Amount got by

A = Amount got by B +(33) 1/3

% of B

= 12187.5 + 33(1/3)% of 12187.5 = 12187.5+ 4062.5 =16250

Amount got By A and B =

16250+12187.5 =28437.5

Amount got by

C= 60% of (amount got by A and B together)

= .6*28437.5 = 17062.5

Verification:

Check the following:

1. 16250 is (33)(1/3)% more than 12187.5

2. 17062.5 is 60% of

(12187.5+16250)

4.1.2

Profit and Loss

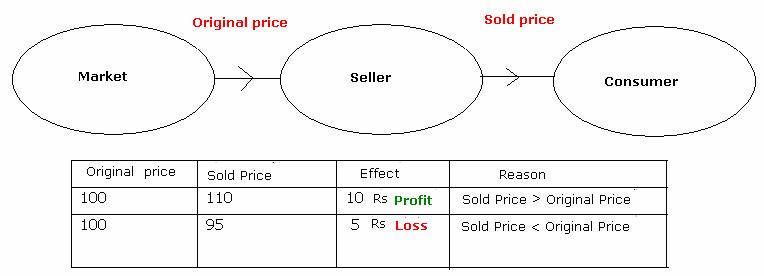

You must have been to

provision stores to buy daily requirements. The merchant sells items at a price

to you after he buys same from the market or a producer of items.

The price at which the item

is sold is called ‘selling price(SP)’.

In order to sell items to you, he has to buy these items from some one, may be

from a producer or from another merchant.

The price at which the item

is purchased is called ‘Cost price(CP)’

The merchant has his own

expenses (He pays rent for the shop, pays for electricity bills, and pays

salary to employees…). For this reason the seller has to sell items at a price

more than the price at which he has bought the items.

The extra money he gets is

difference between selling price and cost price. It is called profit.

Profit = SP-CP (![]() SP>CP)

SP>CP)

There can be situations

where a merchant wants to get rid of old stock of items. In such cases, he may

sell items at a price less than the purchase price. In such cases he incurs

loss.

Loss = CP-SP (![]() SP<CP)

SP<CP)

Though we may buy items in

smaller quantities from the merchant, the merchant always purchases items in

large quantities.

Since the merchant buys in

large quantities he gets some reduction in prices from the first (original)

supplier.

The price at which goods

are bought or sold on a large scale is called ‘Wholesale

price’

The price at which goods

are bought or sold on a small scale is called ‘Retail

price’

Whole sale

price is always < Retail Price.

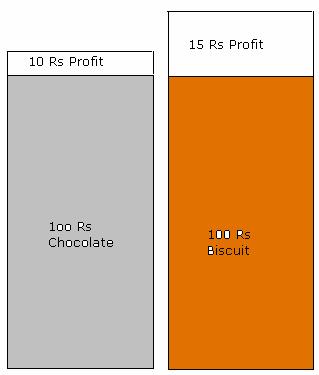

Suppose a shop owner is a

friend of yours. Apart from selling other items assume he sells chocolates and

biscuits as follows:

1. He sells a bar of

chocolate at 11 Rupees which was purchased by him at 10 Rupees

2. He sells a packet of

biscuits at 23 Rupees which was purchased by him at 20 Rupees

He wants to make more

profit. For that, he is not sure whether he should sell more biscuits or more

chocolates. Since you are a student of

mathematics he wants your advice!. What will you

suggest to sell more chocolates or more biscuits?

|

In the

first case for every chocolate of 10Rs, he got a profit of 1Rs. So, for

chocolates of 100 Rs (=10Chcokolate bars) his

profit was 10Rs(=10*1) In the

second case for every biscuit pack of 20Rs, he got a profit of 3Rs. So, for

biscuits of 100 Rs (=5 packs) his profit was 15 Rs (=5*3) So, for

same amount of sale (=100 Rs), he gets 5

Rs(=15-10) extra if he sells biscuit packs. Thus it

is profitable to sell more biscuits than chocolates. |

|

What did we do? In both the

case we arrived at his profit on sale of 100Rs (%) to Cost Price (CP).

The ‘profit percentage’ is the profit made on a Cost

price of 100Rs.

There could be losses on

sales also

The ‘loss percentage’ is the loss made

on a Cost price of 100Rs.

The formulas used for

various calculations are:

Profit = SP-CP

Loss = CP-SP

Profit % = Profit*100/C.P.

Loss % = Loss*100/C.P.

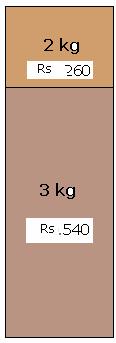

4.1.2 Problem 1: A grocer mixed 3 kg of tea powder at Rs 180Rs

per kg with 2kg of tea powder at Rs.130 per kg. If he sells

the mixture of two at Rs 192 per kg. Did he make profit or loss and what

is the percentage?

Solution :

|

1. Cost

of 3kg tea powder @180 Rs = 3*180*3 = Rs 540 2. Cost

of 2kg tea powder @130 Rs = 2*130*2 = Rs 260 Total

cost of tea powder = Rs 800 By

mixing tea powders he will have total of 5 kg of tea powder. His

sale price of 5kg at Rs 192

= 192*5 = Rs. 960 Since

SP > CP, he has made a profit

|

|

4.1.2 Problem 2: A coconut seller purchased 1000 coconuts for

Rs.6000. Unfortunately 100 coconuts were rotten. He sold remaining coconuts at Rs each. Find the

profit %.

Solution :

Since 100 coconuts were

rotten the seller was left with only 900 coconuts.

![]() The money he got by

selling 900 coconuts at Rs.5 = 900*5 = 4500

The money he got by

selling 900 coconuts at Rs.5 = 900*5 = 4500

Since SP> CP he has made

a loss = CP-SP =6000-4500 = 1500.

![]() Loss % = Loss*100/C.P.=

1500*100/6000 = 25%

Loss % = Loss*100/C.P.=

1500*100/6000 = 25%

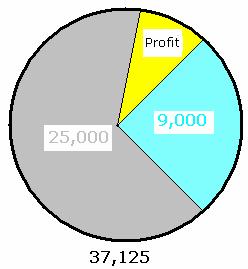

4.1.2 Problem 3 : A shop keeper makes a business of Rs 37,125 in

a month. He spends Rs 25,000 for purchase of items. He pays Rs 9000 towards

rent, salary to employees and other expenses. Find the profit or loss percentage

Solution :

|

His

expenses (equivalent to CP) are Rs 34,000(=25,000+9000) His

income (equivalent to SP) = 37,125 Since

SP>CP, he has a made a profit of SP-CP= 37,125-34,000 = 3125

|

|

If we are given selling price(SP) and profit or loss % , we can find cost price by

the formula

CP = 100*SP/(100+Profit%) when there is a profit

CP = 100*SP/(100-Loss%) when there is a

loss

4.1.2 Problem 4: A fruit seller cuts a papaya into 12pieces

and sells each piece at Rs 2.50.If he gains 50% find the cost price of papaya

fruit

Solution :

|

Since

Papaya fruit is cut in to 12 pieces and selling price of each is Rs 2.50 Selling

price of papaya(SP) = 2.50*12 = Rs 30. His

profit% is given as 50. We are required to find CP Since

he has made a profit of 50% CP = 100*SP/(100+Profit%) = 100*30/(100+50) =

100*30/150 = 20 Rs Veification: SP =30

and CP=20

|

|

4.1.2 Problem 5:

If a vegetable

vendor sells 10 Kg of beans at Rs71.25 and incurs a loss of 5%, What is his cost price?

Solution :

Since he has made loss of

5%

CP = 100*SP/(100-Loss%) = 100*71.25/(100-5) = 100*71.25/95 = 75Rs

Veification:

SP =71.25 and CP=75

![]() Loss = CP-SP =

75-71.25 = 3.75 Rs

Loss = CP-SP =

75-71.25 = 3.75 Rs

![]() Loss % = Loss*100/C.P =

3.75*100/75 = 5% which is the loss% as given.

Loss % = Loss*100/C.P =

3.75*100/75 = 5% which is the loss% as given.

If we are given Cost price(CP) and profit or loss % , we can find List price by the formula

SP = (100+Profit %)*CP/100

when there is a profit.

SP = (100-Loss %)*CP/100

when there is a loss.

4.1.2 Problem 6: Let us understand how an item manufactured by

a manufacturer reaches a buyer. Firstly, the item is manufactured by a

manufacturer. Then, the manufacturer sells the items to a Wholesale merchant.

Then the wholesale merchant sells the

items to retailers. Finally retailer sells the item to Buyer.

|

|

A manufacturer gains 50% on

each item when an item is sold to a wholesale merchant. Wholesale merchant

gains 25% on each item sold to retailer. Retailer gains 10% on each item sold

to a buyer. If cost of manufacturing an item is Rs 200. Find out the price paid by an

individual.

Solution :

We need to find SP of an

item by Manufacturer, Wholesale Merchant and Retailer.

Since each one is making a

profit we need to use the formula: SP = (100+Profit %)*CP/100

SP of a manufacturer =

(100+50)*200/100 = 300Rs ( ![]() CP of a Manufacturer is 200)

CP of a Manufacturer is 200)

SP of a Wholesale merchant

= (100+25)*300/100 = 375Rs ( ![]() CP of a Wholesale merchant is 300)

CP of a Wholesale merchant is 300)

SP of a Retailer =

(100+10)*375/100 = 412.50 Rs ( ![]() CP of a Retailer is 375)

CP of a Retailer is 375)

Veification:

Let us find gain for Manufacturer ,Wholesale merchant,Retailer:

For Retailer SP =412.50 and

CP=375

![]() Profit = SP-CP =

412.50-375 = 37.5

Profit = SP-CP =

412.50-375 = 37.5

![]() Profit % =

Profit*100/C.P = 37.5*100/375 = 10% which is the gain as given.

Profit % =

Profit*100/C.P = 37.5*100/375 = 10% which is the gain as given.

For Wholesale merchant SP =375 and

CP=300

![]() Profit = SP-CP =

375-300 = 75

Profit = SP-CP =

375-300 = 75

![]() Profit % =

Profit*100/C.P = 75*100/300 = 25% which is the gain as given.

Profit % =

Profit*100/C.P = 75*100/300 = 25% which is the gain as given.

For Manufacturer SP =300 and CP=200

![]() Profit = SP-CP =

300-200 = 100

Profit = SP-CP =

300-200 = 100

![]() Profit % =

Profit*100/C.P = 100*100/200 = 50% which is the gain as given.

Profit % =

Profit*100/C.P = 100*100/200 = 50% which is the gain as given.

4.1.2 Problem 7: By selling an article for Rs 23 a man lost 8%.

At what price should he sell it to make a profit of 10%?.

What is the cost price of the article?

First we need to calculate

CP and then find SP

Solution :

Since man has lost 8% by

selling at Rs 23.

CP = 100*SP/(100-Loss%) = 100*23/(100-8) = 100*23/92 = Rs 25

Since he has to make a

profit of 10% on a CP of Rs 25

SP = (100+Profit %)*CP/100 =

(100+10)*25/100 = 110*25/100 = Rs.27.5

Veification:

When the man sold at a loss

CP =25, SP =23: loss =

CP-SP = 25-23 =2

![]() Loss % = Loss*100/C.P = 2*100/25 = 8% which is

the loss% as given when he sold the article at Rs.23

Loss % = Loss*100/C.P = 2*100/25 = 8% which is

the loss% as given when he sold the article at Rs.23

When he makes a profit

SP=27.5(as Arrived at above) and CP is still =Rs25

he

has made a profit = SP-CP = 27.5-25 = 2.5

![]() Profit % =

Profit*100/C.P= 2.5*100/25 =10% which is as given

Profit % =

Profit*100/C.P= 2.5*100/25 =10% which is as given

4.1.2 Problem 8: A merchant purchased 1000 cucumbers for Rs.3800.He

paid 2% tax and spent Rs.50 on transportation.40 of them were spoiled. At what

price should he sell the remaining to gain Rs.1114 on the whole?

Solution :

Since we want to know his

SP, first we need to calculate the CP. The CP should include his purchase

price, tax and transportation.

Purchase price of 1000

cucumbers = 3800

Tax at 2% on RS 3800 =

3800*2/100 = 76

Transportation cost = 50

Total CP =

3926

SP = CP+ profit = 3926+1114

= 5040

Since 40 cucumbers were

spoilt he could sell only 960

![]() His rate of sale of

cucumber = 5040/960 =

Rs 5.25

His rate of sale of

cucumber = 5040/960 =

Rs 5.25

Veification:

SP = no of cucumbers * rate = 960*5.25 =

5040

Profit = SP-CP = 5040-3926

= 1114 which is as given in the Problem

4.1Summary

of learning

|

No |

Points to remember |

|

1 |

Profit

= CP-SP (When SP>CP) |

|

2 |

Loss =

SP-CP (When SP<CP) |

|

3 |

Profit

% = Profit*100/C.P |

|

4 |

Loss %

= Loss*100/C.P |

|

5 |

CP =

100*SP/(100+Profit%) (when there is a profit) |

|

6 |

CP =

100*SP/(100-Loss%) (when there is a loss) |

|

7 |

SP =

(100+Profit %)*CP/100 (when there is a

profit) |

|

8 |

SP =

(100-Loss %)*CP/100 (when there is

a loss) |

Additional Points:

4.1.2 Problem 9:

A man sells a TV set for Rs 6900 and makes a profit of 15%. He sells a second

set at a loss of 10%. If on the whole he neither gains nor loses, find the cost

price of the second TV set.

Solution:

SP = 6900. Profit% = 15

We know CP = 100*SP/(100+Profit%). By substituting values we get,

CP = 100*6900/115

= 6000

We also know that Profit =

CP-SP and hence

Profit = 6900-6000 = 900

Since in all he does not

make any profit or loss, it is clear that he incurs a loss of Rs 900 while

selling the second set.

We know

Loss % = Loss*100/C.P

Therefore

10 = 900*100/CP

And hence CP = 9000

Thus the cost price of

second TV set is Rs 9000.

4.1.2 Problem 10: A man bought two transistors which costed him Rs 720. He sold one of

them at a loss of 15% and the other at a gain of 19%. If the selling price of

both transistors is same find the cost price of each transistor.

Solution:

Let x be the cost price of

first transistor.

![]() The cost price of

second transistor is 720-x.

The cost price of

second transistor is 720-x.

When sold at a loss we know

SP = (100-Loss

%)*CP/100

SP

= (100-15)*x/100 = 85x/100

Since the 2nd transistor

was sold at profit we know

SP = (100+Profit

%)*CP/100

SP

= (100+19)*(720-x)/100 = 119*(720-x)/100

Since SP of both

transistors is same, we have

85x/100

= 119*(720-x)/100

i.e. 85x = 119(720-x) = 119*720 - 119x

i.e. 85x+119x = 119*720

i.e. 204x = 119*720

x = 119*720/204 = Rs 420

which is the cost price of first transistor

![]() The CP of second

transistor = 720-x = 720-420 = Rs 300

The CP of second

transistor = 720-x = 720-420 = Rs 300

Verify that above working is correct.